Getting The Feie Calculator To Work

Indicators on Feie Calculator You Should Know

Table of ContentsSome Known Incorrect Statements About Feie Calculator Getting My Feie Calculator To WorkAn Unbiased View of Feie CalculatorFeie Calculator Things To Know Before You BuyRumored Buzz on Feie CalculatorFeie Calculator for BeginnersWhat Does Feie Calculator Mean?

If he 'd frequently traveled, he would certainly instead finish Part III, providing the 12-month period he fulfilled the Physical Existence Examination and his travel background. Action 3: Reporting Foreign Revenue (Part IV): Mark earned 4,500 per month (54,000 annually).Mark determines the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his wage (54,000 1.10 = $59,400). Given that he lived in Germany all year, the percent of time he resided abroad throughout the tax obligation is 100% and he gets in $59,400 as his FEIE. Ultimately, Mark reports overall salaries on his Type 1040 and enters the FEIE as a negative amount on time 1, Line 8d, minimizing his gross income.

Picking the FEIE when it's not the finest option: The FEIE might not be ideal if you have a high unearned income, make greater than the exemption limit, or stay in a high-tax nation where the Foreign Tax Credit Score (FTC) may be more useful. The Foreign Tax Obligation Credit History (FTC) is a tax obligation decrease method usually made use of in combination with the FEIE.

Not known Factual Statements About Feie Calculator

expats to counter their U.S. tax financial debt with foreign income taxes paid on a dollar-for-dollar decrease basis. This means that in high-tax countries, the FTC can often eliminate united state tax obligation debt entirely. The FTC has constraints on qualified taxes and the maximum claim amount: Qualified tax obligations: Only earnings tax obligations (or taxes in lieu of income tax obligations) paid to international federal governments are eligible (FEIE calculator).

tax liability on your international earnings. If the foreign taxes you paid surpass this limit, the excess international tax obligation can normally be continued for up to 10 years or lugged back one year (via an amended return). Keeping exact documents of foreign revenue and taxes paid is as a result crucial to calculating the appropriate FTC and keeping tax obligation compliance.

migrants to minimize their tax obligation responsibilities. If an U.S. taxpayer has $250,000 in foreign-earned earnings, they can leave out up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 might then be subject to taxes, however the U.S. taxpayer can possibly use the Foreign Tax Credit rating to counter the taxes paid to the international nation.

Unknown Facts About Feie Calculator

Initially, he offered his U.S. home to develop his intent to live abroad completely and made an application for a Mexican residency visa with his wife to aid meet the Authentic Residency Test. Furthermore, Neil secured a lasting building lease in Mexico, with plans to eventually buy a residential or commercial property. "I presently have a six-month lease on a home in Mexico that I can extend an additional six months, with the intent to purchase a home down there." Neil directs out that buying building abroad can be testing without initial experiencing the place.

"We'll absolutely be outside of that. Also if we return to the United States for doctor's appointments or company telephone calls, I question we'll spend greater than thirty day in the United States in any type of provided 12-month period." Neil highlights the importance of stringent monitoring of united state gos to. "It's something that people need to be actually diligent about," he claims, and suggests expats to be careful of typical blunders, such as overstaying in the united state

Neil is careful to stress to united state tax obligation authorities that "I'm not carrying out any kind of organization in Illinois. It's just a mailing address." Lewis Chessis is a tax obligation expert on the Harness system with substantial experience assisting U.S. residents navigate the often-confusing world of international tax obligation compliance. One of one of the most usual misconceptions among U.S.

Feie Calculator Can Be Fun For Anyone

income tax return. "The Foreign Tax obligation Credit score enables individuals functioning in high-tax nations like the UK to counter their united state tax liability by the amount they've currently paid in taxes abroad," claims Lewis. This guarantees that deportees are not taxed two times on the same income. However, those in low- or no-tax nations, such as the UAE or Singapore, face additional obstacles.

The possibility of reduced living expenses can be appealing, yet it frequently comes with compromises that aren't right away noticeable - https://www.openlearning.com/u/feiecalculator-t03qal/. Real estate, for instance, can be more economical in some nations, but this can suggest compromising on infrastructure, safety, or access to reliable utilities and services. Low-cost buildings could be found in areas with inconsistent net, minimal public transport, or unstable healthcare facilitiesfactors that can significantly impact your everyday life

Below are several of one of the most regularly asked inquiries regarding the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) permits united state taxpayers to omit approximately $130,000 of foreign-earned income from federal revenue tax, lowering their united state tax obligation. To receive FEIE, you have to fulfill either the Physical Existence Examination (330 days abroad) or the Authentic House Examination (prove your main residence in a foreign nation for a whole tax year).

The Physical Existence Test requires you to be outside the united state for 330 days within a 12-month duration. The Physical Visibility Test additionally calls for united state taxpayers to have both an international earnings and a foreign tax obligation home. A tax obligation home is defined as your prime location for business or employment, regardless of your household's home. https://pubhtml5.com/homepage/ghgsv/.

Feie Calculator - Questions

An earnings tax treaty between the united state and an additional country can aid prevent dual taxation. While the Foreign Earned Earnings Exemption lowers gross pop over to this site income, a treaty might supply extra benefits for eligible taxpayers abroad. FBAR (Foreign Financial Institution Account Record) is a called for declaring for united state people with over $10,000 in foreign monetary accounts.

The international made income exemptions, sometimes referred to as the Sec. 911 exclusions, leave out tax on earnings earned from working abroad. The exclusions make up 2 components - an earnings exemption and a housing exemption. The complying with Frequently asked questions go over the advantage of the exclusions consisting of when both spouses are deportees in a basic fashion.

Rumored Buzz on Feie Calculator

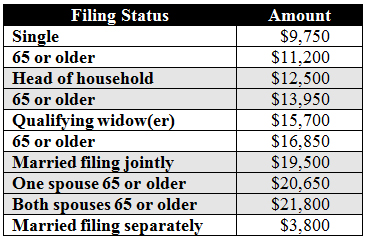

The earnings exclusion is now indexed for rising cost of living. The maximum annual income exclusion is $130,000 for 2025. The tax advantage excludes the earnings from tax obligation at bottom tax obligation prices. Previously, the exclusions "came off the top" minimizing earnings based on tax on top tax obligation prices. The exemptions might or may not lower income utilized for various other purposes, such as IRA limitations, kid credit ratings, personal exemptions, and so on.

These exclusions do not excuse the earnings from United States taxation but merely offer a tax reduction. Note that a solitary individual functioning abroad for every one of 2025 that made regarding $145,000 with no other income will have gross income reduced to no - effectively the same solution as being "tax obligation totally free." The exclusions are calculated every day.

If you participated in business conferences or seminars in the US while living abroad, income for those days can not be excluded. Your wages can be paid in the United States or abroad. Your company's area or the location where salaries are paid are not factors in receiving the exclusions. American Expats. No. For United States tax obligation it does not matter where you keep your funds - you are taxed on your around the world revenue as an US individual.